Tata Neu's Engagement Problem: A User's Perspective

Hypothesis: A subscription model can boost Tata Neu's engagement by addressing the unique needs of horizontal app user

Tata Neu is compelling, but I haven’t used it in 2 months.

The all-in-one app is designed for convenience. I shop from Amazon as it’s convenient.

Tata Neu delivers convenience, but then why didn’t I use it?

This is a hypothetical case study on how to increase activated users for Tata Neu from a Product Marketer’s experience.

Sponsored by yours truly, Ryan Dsouza. I'm on a campaign to land a Product Marketing / PLG role at incredible product companies like Tata Digital. If you happen to know any open positions in product marketing - I’d be thrilled to interview.

I spent 20+ hours working on this, so let's dive in and make it worth your time!

#1. Understanding the Missing Habit Loop

The first time I opened Tata Neu after months of inactivity, I immediately asked myself, "Why don't I use this more often?"

Unlike Amazon, which I visit almost daily to price-check or browse, Tata Neu lacked a compelling reason to return. Amazon excels at creating a habit loop:

With Amazon, there is a habit loop trigger:

Cue: I think about buying something – for myself or as a gift.

Routine: Search Amazon. Find options. Fast shipping.

Reward: The item arrives, meeting my needs (and often exceeding expectations).

Where does Tata Neu falter in this loop? To explore this, let's define two potential high-value use cases:

Use-case 1: Caring for my parent’s health.

Use-case 2: Effortless weekly grocery delivery

Horizontal products have multiple product champions, and creating cue-routine-reward triggers from the neu app would be critical to driving engagement.

Lets talk about a hypothetical cue-routine-reward for refilling my parent’s medications via Neu.

Problem: Walking to the pharmacy to get recurring medication for my parents is time-consuming and prone to missed doses.

Cue: When medications running out.

Routine: Easily search for medications on Tata Neu, set up a subscription for automatic refills, and track delivery.

Reward: Peace of mind knowing their medications are always on hand, delivered reliably. Personalization based on doctors inputs can lead to potential upsells.

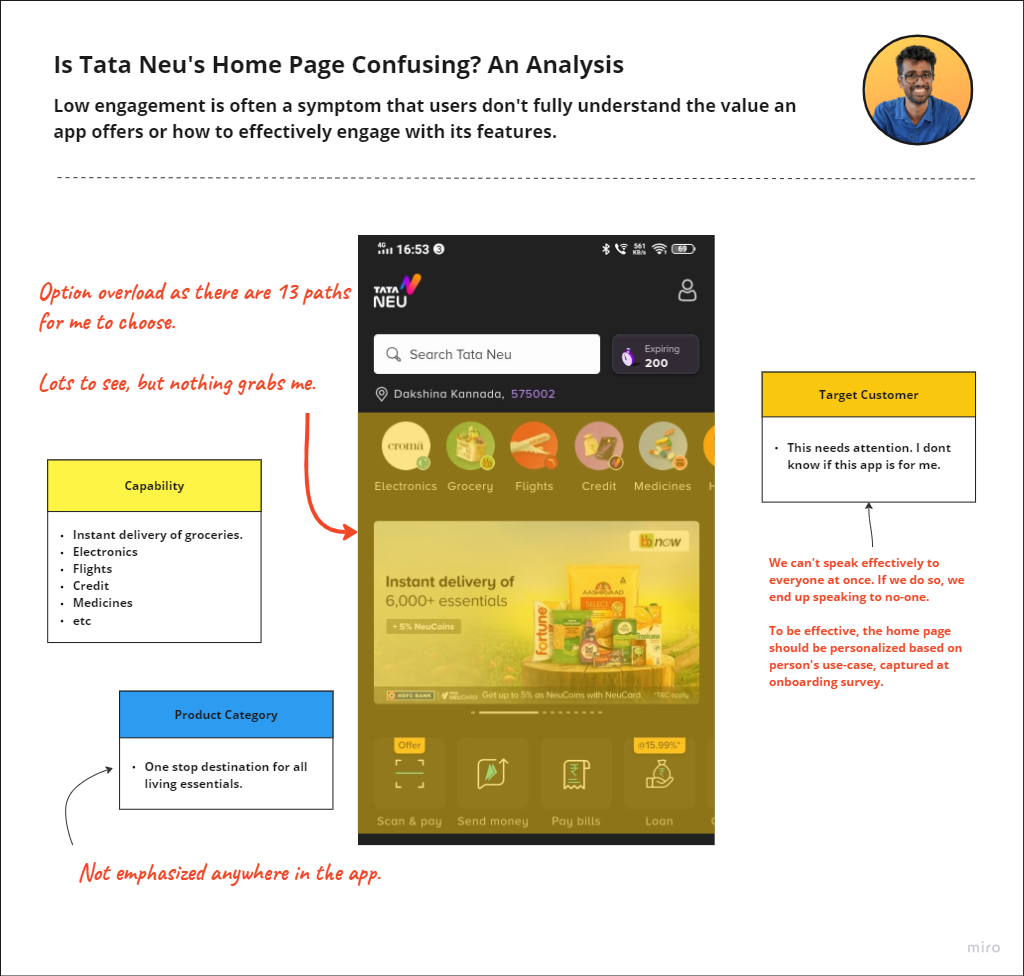

Make the use cases for different user segments clear on the home page. This personalization for each user segment is based on the onboarding questionnaire they fill out. When they open the app after, like I did, we could

Emphasize the Cue: The homepage could feature prominent sections titled "Parent Care" and "Groceries Made Easy." These act as immediate visual cues.

Simplify the Routine: Reduce the number of steps required to order medicine or build a grocery list. Streamlined search, saved lists, and clear delivery options make the process effortless.

Highlight the Reward: Emphasize convenience and reliability. This reinforces the positive outcome (peace of mind, saved time) for the user.

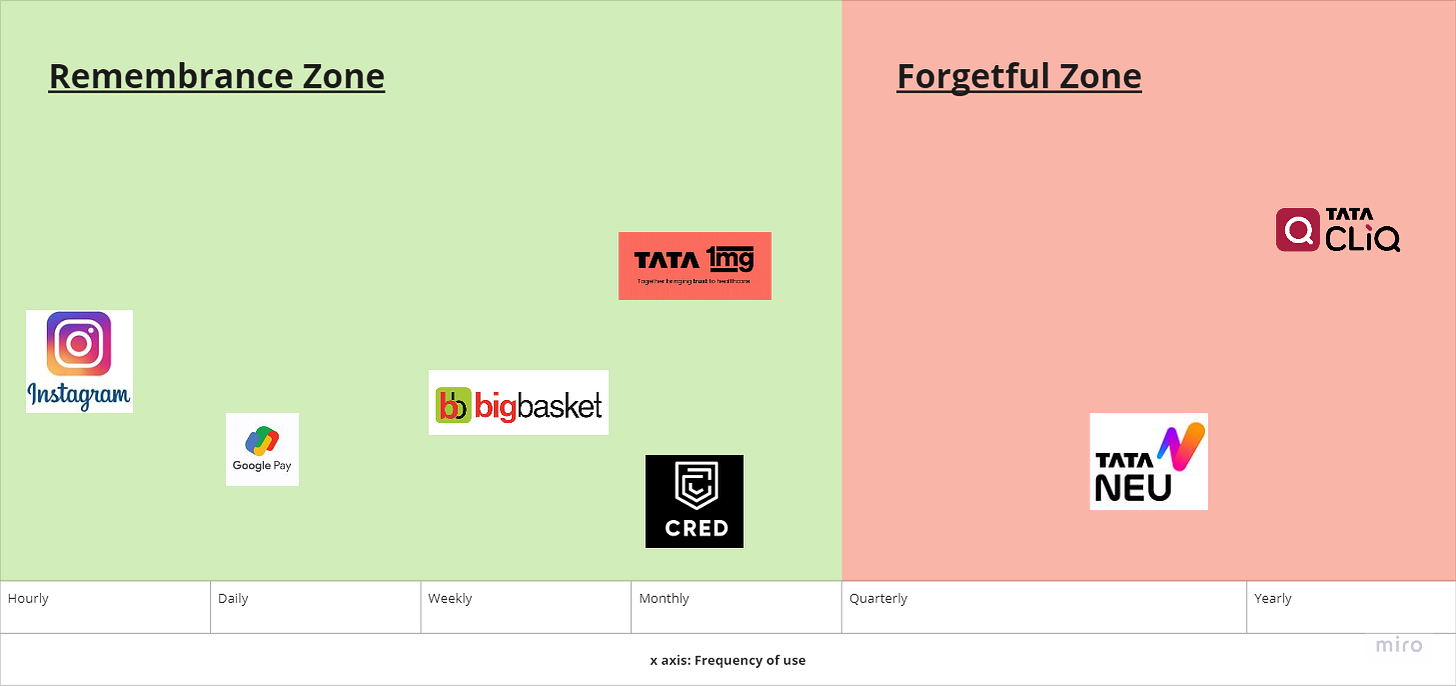

The home page triggers the cue. Now let’s identify the product’s natural usage frequency, to understand the reasonable upper bounds of our cue-routine-reward cycles per year.

#2 Understanding Natural Use Patterns: The Key to Engagement

Every product has a natural frequency of use dictated by user needs. CRED, for example, aligns with the monthly cycle of credit card bill payments. Success came from understanding this pattern:

Cue: Credit card bill due date approaches.

Routine: Open CRED, check statement, pay the bill.

Reward: Peace of mind, on-time payment, potential rewards.

To drive more frequent engagement, CRED expanded beyond core bill payments, offering services like UPI and traffic challan checks.

Hypothetical Patterns for Tata Neu

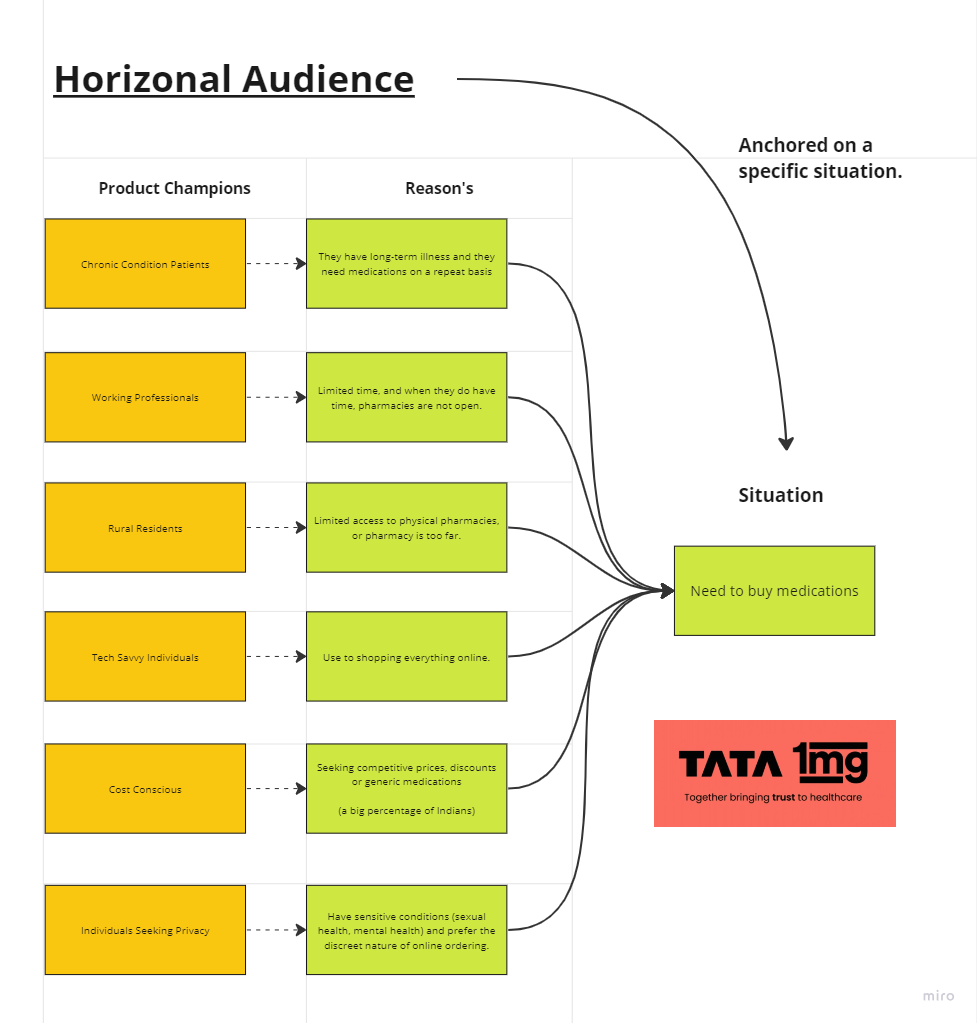

1MG: Monthly medication refills for chronic conditions establish a potential baseline.

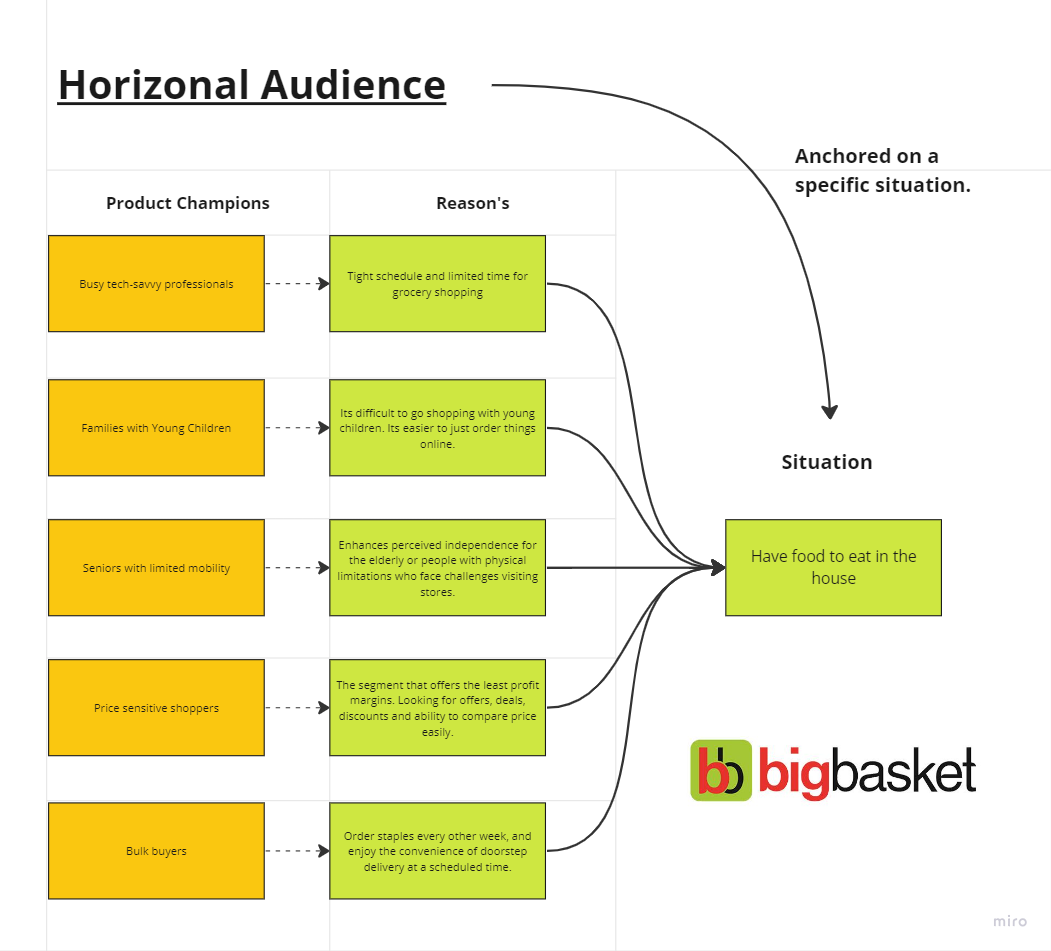

Bigbasket: Weekly grocery shopping is a common, recurring need. Our focus here is on maximizing cart value for profitability, favoring scheduled delivery over hyperlocal instant models.

Our goal with pattern usage is to be in the remembrance zone.

Position services to incentivize frequent use, to create daily or weekly usage cycle. And competing for UPI market share is a lost goal. Best to accept defeat in that arena (bold statement, but if loan disbursals is the target, CRED’s business model is a proven go-to-market approach)

This brings us to the crucial question: How can Tata Neu effectively integrate diverse offerings like 1MG, BigBasket, Croma, Tata Cliq, and more, into a cohesive "everything app" experience?

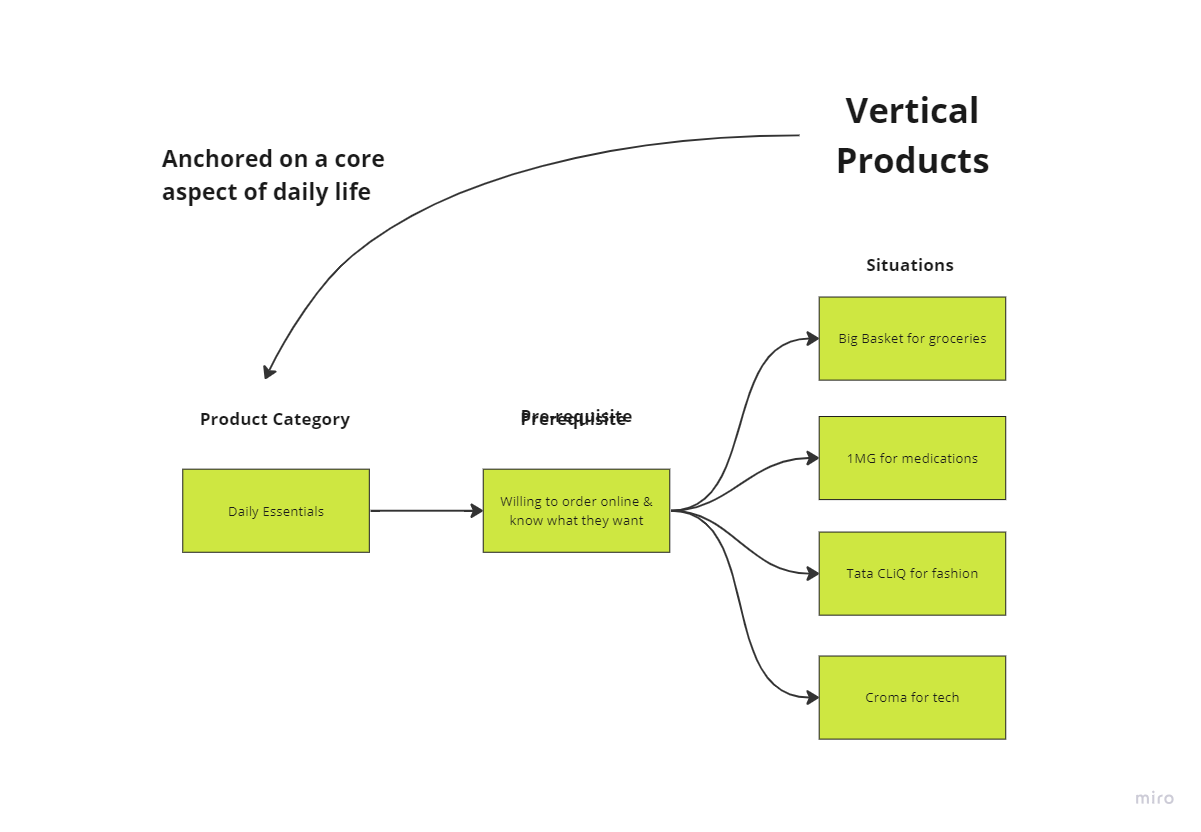

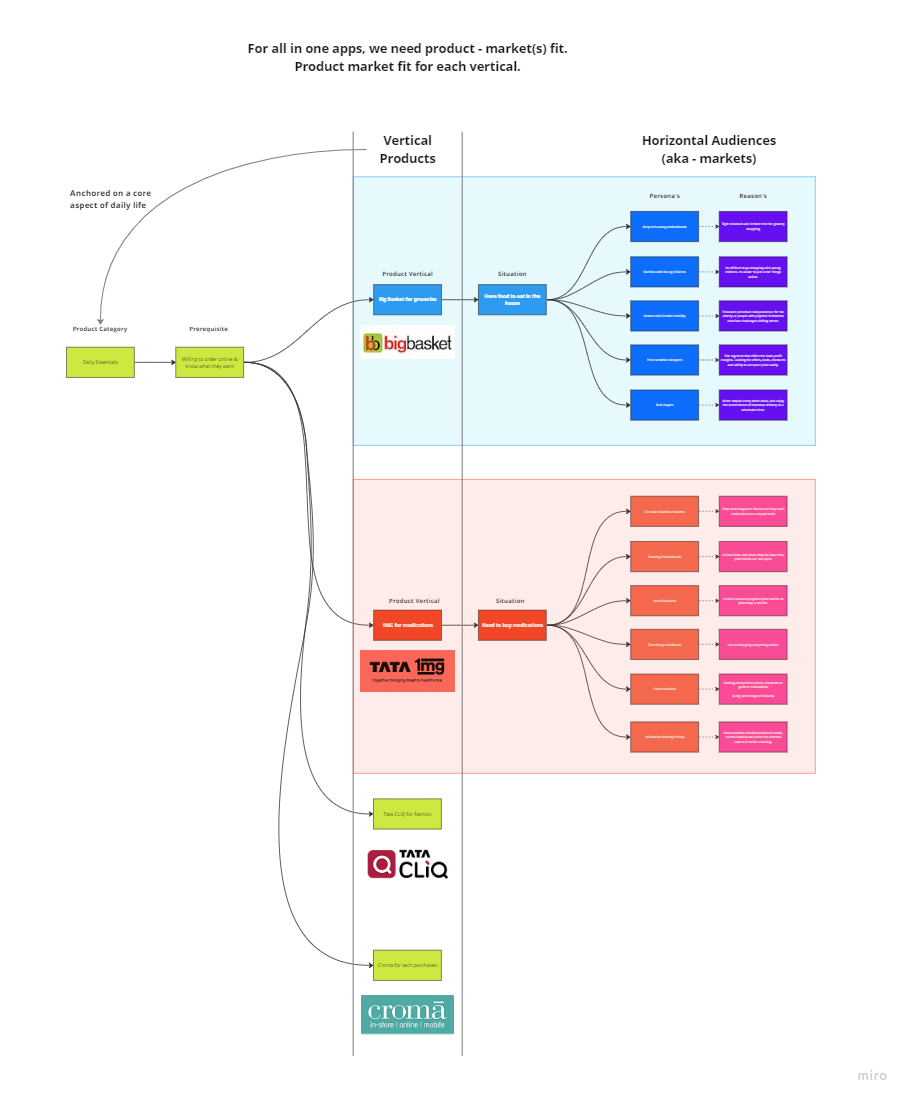

#3. It’s about product market[s] fit. Not Product Market Fit.

Building a successful "everything app" relies on a core theme, and for Tata Neu, this seems to be a daily essentials. However, a key prerequisite is the user's comfort with online purchases.

Within this overarching theme, Tata Neu houses several vertical products (Bigbasket, 1MG, Tata Cliq, etc.), each with its own distinct product-market fit. Even within a single product like Bigbasket, different user personas exist:

Busy Tech-Savvy Professionals: Seek convenience and time-saving.

Price-Sensitive Shoppers: Prioritize deals and discounts.

Moms with Young Children: Prioritize product selection and ease of use.

Therefore, it's crucial to achieve product-market fit for each vertical within the app. Some verticals might see more traction than others, with specific personas demonstrating greater engagement.

If you relate my previous topic on horizontal audiences for BigBasekt and Tata 1MG, you will start to see the real reason why all-in-one apps have a hard time penetrating the market. You have to cater to each horizonal audience within each vertical, within an all-in-one app. With 10 brands each catering to 5 different personas, you quickly end up with 50 potential combinations for how any given person might interact with the app.

The ultimate goal is Netflix-level personalization, where the experience dynamically adapts to individual preferences evolving over time.

Just as Netflix tailors movie thumbnails, Tata Neu should cater to diverse needs for each vertical. However, achieving this hyper-personalization from the get-go is unrealistic.

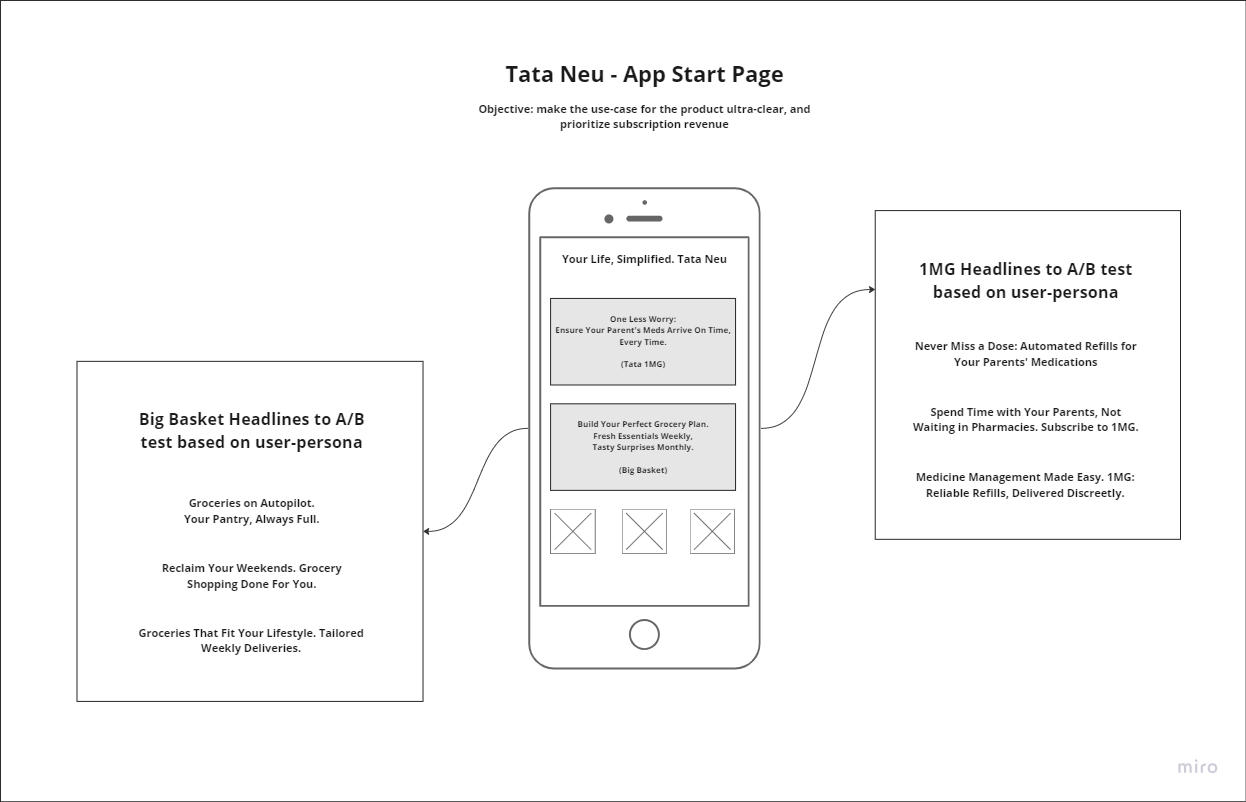

So, the first step. Let's start by redesigning the homepage for a single, well-defined user persona. Goal: How can we communicate the product to maximize habit loops?

#4 The New Homepage: Focus on time saving outcomes

The goal I am pursuing is to maximize habit loops for tech-savvy professionals so they have one less thing to worry about. I remember working into the night, only to realize I didn’t have dinner ready and my pantry was empty. It’s a common theme in my life.

So, what does a home page for tech-savvy professionals who need time back look like?

Why do I believe this will work?

We target 2 of the biggest marketing archetypes while helping working professionals get time back. It’s one less thing for them to worry about.

Pain-point based messaging

Never Miss a Dose: Automated Refills for Your Parents' Medications.

Groceries on Autopilot. Your Pantry, Always Full.

Audience based messaging

Spend Time with Your Parents, Not Waiting in Pharmacies. Subscribe to 1MG.

Groceries That Fit Your Lifestyle. Tailored Weekly Deliveries.

When you personalize the messaging to make the overall package more appealing to the end user, and then add the fact that they get their time back, you will quickly attract the Top 1% of buyers.

That’s the first audience segment you want to attract. Not the deal seekers. But the ones who have the means to pay for your services.

Build relationships with them, and grow sustainably.

#5 The flaw in my research

All business plans have assumptions layered in them. Effective marketers understand these assumptions and validate them in isolation until we reach the implied truth of the game.

I remember once building a go-to-market strategy for a Crypto research tool, and only in the execution phase did we realize the assumption upon which we built our product was flawed.

The biggest assumption in this research:

Subscription revenue in India is possible. Very few Indian companies have successfully launched subscription services - and for the right reasons. As much as I love India, I feel we are spoilt users. We want things at the cheapest price possible, as soon as possible, and we want to select from as many options as possible. Hyper-local platforms now delivering noise-cancellation headphones in 10 minutes is unwavering proof of it.

Its ironic Jeff Bezos built Amazon in the US, tailed for the Indian markets.

So why am I convinced a subscription will work?

Cracking subscription revenue is a matter of value. Ather has an even split in scooter sales across Tier 1, 2, and 3 cities, which indicates people have misunderstood the Indian market.

India is a demand-constrained market, not a supply-constrained market.

Don’t build an everything app. Build an omnipresence experience.

Everything app is a good focus. But in this pursuit, don’t separate online and offline shopping experiences. I notice Croma online and Croma offline are not integrated shopping experiences.

The future will lean towards an online offline experience.

Customers will see something on social media, research it on Amazon, and if it’s an expensive purchase, visit a local store and buy it from there.

Take it one step further, after visiting the store, they will buy it from their phone. Why?

We are pampered with convenience. We are used to having items delivered to our doorstep with just one click.