Building Strategic Differentiation for a WhatsApp CRM

Hypothesis: Customers are willing to pay 10x more if we prove we can deliver higher repeat customers

Wati.io is a Whatsapp CRM. I got intrigued as they have a job opening for a product marketer, but I became curious as they focus exclusively on SMEs.

Very few companies are THIS clear on their target audience.

The Whatsapp CRM space is certain to become a commodity in 10 years, as no other platforms offer open rates of 98% and engagement rates of 60%. (link to source). Via emails, on your lucky day you have 60% open rates with 5% click-through open rates.

So the big question this blog is written to answer is how do we build a strategic differentiation for Wati that will help the business scale past 10 million dollars in ARR in our Tier 1 markets?

Strategic differentiation is critical as if we don't prioritize it, we will compete in a commodity marketplace, differentiated only by price. It's like me deciding to open a local bookstore in a world dominated by Amazon. I won't win. But with a positioning like Bookshop.org, I have a good chance.

Now, let's dive in and craft Wati's differentiation.

#1. The Founders and the Leadership are clear

Here's what I read in Wati’s about section.

It’s rare for founders and top management to be this clear. Most founders want to serve everyone, and in that pursuit, it’s hard to standardize processes. One good to have could have been primary demographics where they are concentrating their go-to-market efforts. This would help us estimate the market size, and give the sales team a proxy goal of, “How many SMEs in this country did we get on a phone call?”.

Before I get ahead of myself in identifying go-to-market strategies by region, I am so thrilled by how clear Wati's leadership is.

#2. How to build strategic differentiation?

Just typing in WhatsApp CRM gave me the below list on Google.

Now, the big question is, how do we make Wati stand out from the rest?

I dislike competing on price, as someone can always be cheaper. And if we reduce our margins, we will not be able to pursue quality distribution channels needed for higher-paying customers. I believe that price is relative to the value we create. If we offer just a tool, we can only charge for the tool. But if we own the acquisition channel for the client, and make it their highest-performing conversion channel, we can charge higher and become indispensable to the company’s operations. (more on this soon).

Before going ahead, I want to share there are two paths ahead. In one, we become the end product like Hubspot, and on the other extreme, we become an invisible layer like Twilio. Both options are valid, but as WhatsApp controls the APIs, going the end-product route makes the most sense. And on this assumption, I’ve built my product marketing thesis listed below.

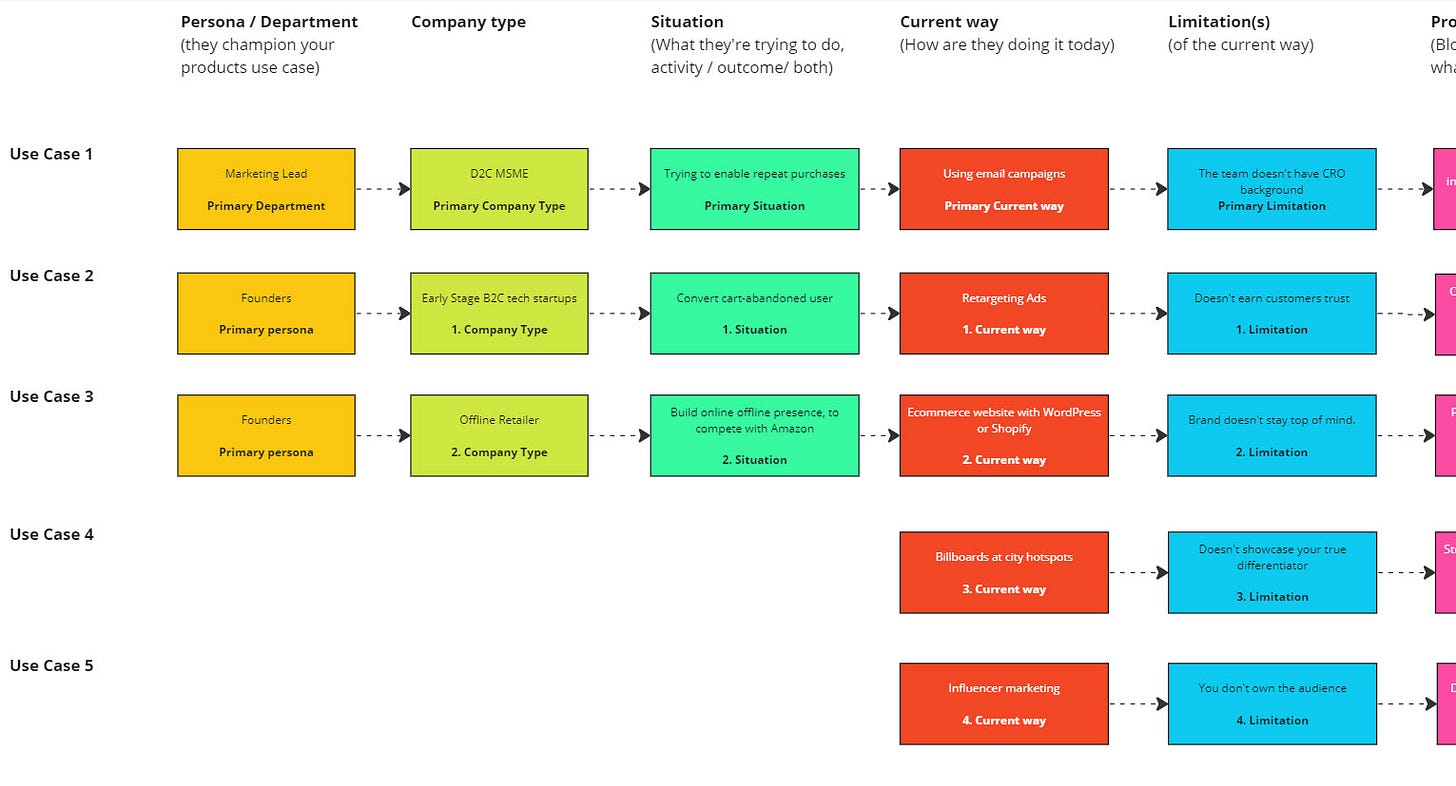

I studied the core use cases listed on the website and drafted the below user journey. It gives visibility into how we can leverage different customer pain points.

I focus on product champions as if we demonstrate ourselves as the right product for their needs, they will get the “conservatives” on board.

Product champions are the ones looking for a solution, and once they find a perfect fit, you just need to enable them to get others on board.

The conservatives focus on ensuring people don't screw up (security, legal, compliance, purchasing, often IT).

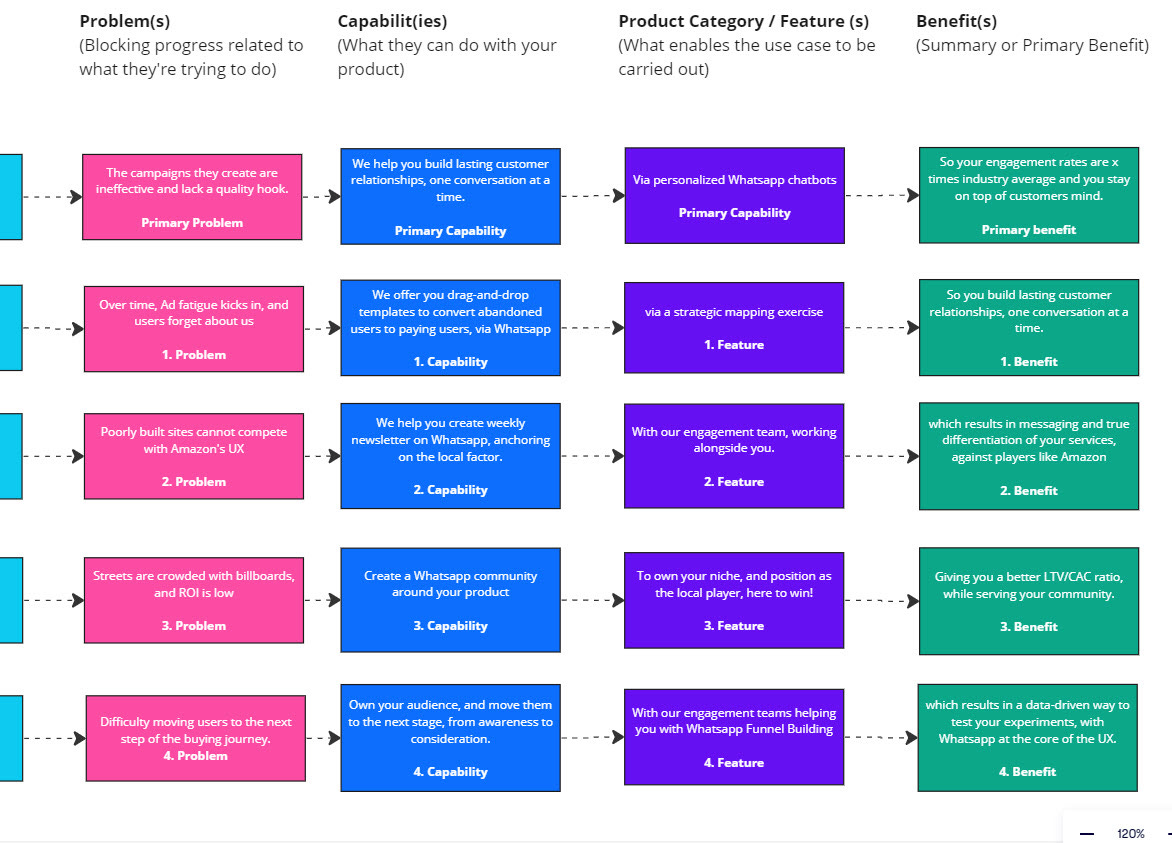

I want to move forward with the context of Marketing Managers in D2C MSMEs as champions who want to boost repeat purchases. They try email campaigns, but since they are experts in reach, not CRO, their efforts fall flat. The email headlines are ineffective and people don’t read their lengthy emails. Once they hear from us that WhatsApp's open rate is 98% and engagement rate is 60% (compared to 1.2% via emails, an entire 50x difference), they will be quick to schedule a call.

This is where we come in. We assist them in building lasting relationships with customers using WhatsApp as the channel. We handhold them from message sequences to delays, and other proven processes to enable repeat purchases. In a way, they outsource the entire WhatsApp acquisition channel to us.

This is a golden place to be, as now, we can test across 100s of our clients on how to improve a metric everyone wants help with (let’s assume it’s repeat customers). For example, think of repeat flower purchases delivered to your doorstep every month, or garden soil delivered every three months to repot your plants. All these upsells are mediated via WhatsApp channels instead of ineffective emails.

The direct outcome for the client by working with us:

At a minimum, 3x higher engagement rates than their current marketing efforts.

# times higher LTV per user, after working with us for 3 months (we need to study and benchmark this number)

Complete ownership of a high-converting acquisition channel, giving our client proven expertise at a fractional cost of a full-time hire.

Effective research is needed to understand the true pain points of the user and how they intend to measure our effectiveness. After the research, we can group study participants by personas, and start partnering with MSMEs with the highest employee count.

The flowchart above took 4 hours to build and is layered with 5+ years of experience in Product Marketing. Each flow gives insights into how we can solve problems for the user. In the real world, we will do it after studying the users, but for now, the personas are simulated with AI.

#3. Company to take inspiration from

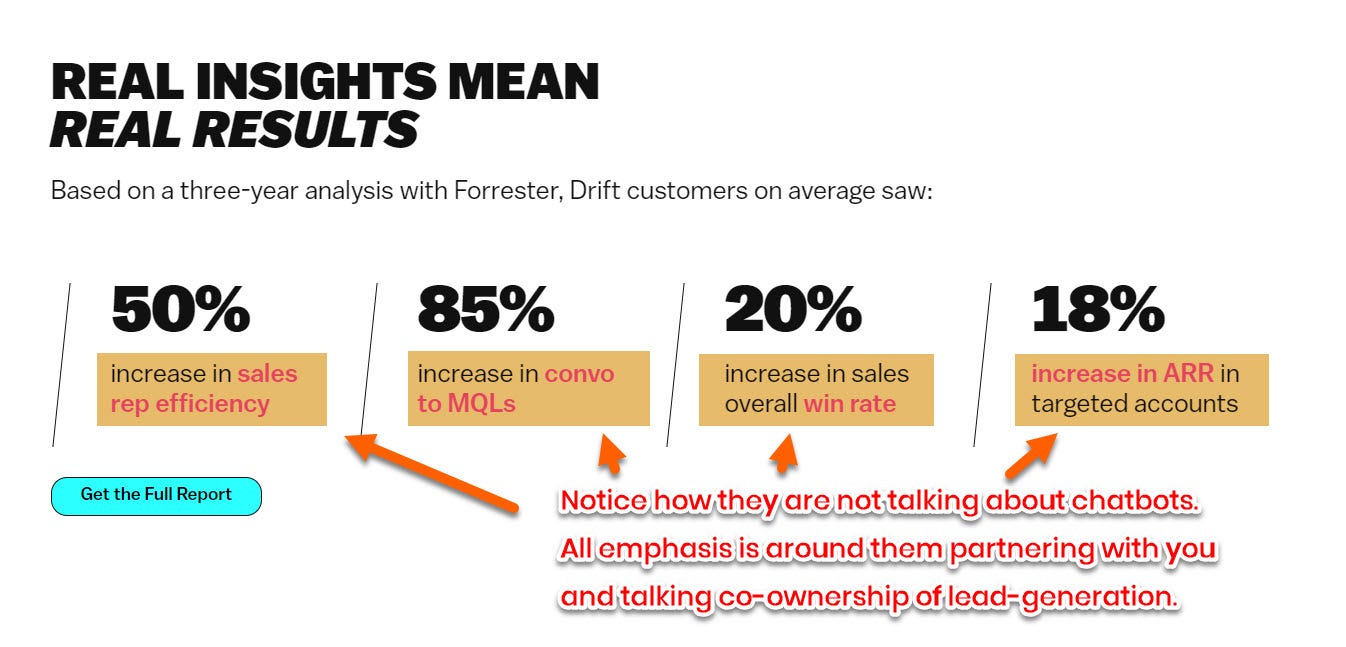

The best company to look at is Drift. They started with a chatbot being sold at 70 dollars per month, and now their starting price is 2,000 dollars per month. (that’s ~28 times more in Year 1 revenue).

They initially sold chatbots, which gave them insights on winning chat scripts, and then they started working up the ladder until they owned the entire chat-driven acquisition pipeline. For the companies they partner with, it’s one less headache for them to worry about, as Drift takes complete ownership of chat-driven conversions as Drift engagement team can benchmark message scripts across 1000s of other companies in their benchmarking portfolio.

Here’s a direct quote from their website.

With this new positioning, we have mathematical proof that their year 1 revenue has gone up 28 times, giving them more budget to build incredible products and acquire higher quality clients. I have a feeling that their CAC might be the same, as enterprise clients looking for chatbots are actually looking for proven chat-driven conversational tools, and they would prefer the latter if they get guaranteed results.

#4. The main flaw in my analysis

Product marketing is a very customer-facing role. Studying sales calls, service email conversations, etc. You need to know precisely what the top 3 personas want, in crystal clear data, so you can build product positioning and messaging thinking about them. I have made a lot of assumptions here, driven around my initial hypothesis which is, “Customers are willing to pay 10x more if we prove we can deliver higher repeat customers”. We just have to test this hypothesis.

A few clarifying questions for internal stakeholders, before interviewing customers.

Where do we want our growth to come from, in the next 6-12 months?

Which groups can we reasonably expect to reach, given our current go-to-market muscle?

Are we trying to create or capture demand in the current strategy?

Few questions to ask, when we debrief after every customer interview

What motivates this customer to buy?

What are their pain points?

How would each segment of the audience feel differently? (separation between buyers and end users)

#5. How to execute?

It’s always about execution, and this is where experience pays off.

This is my preliminary execution plan, to identify if our hypothesis, “Customers are willing to pay 10x more if we prove we can deliver higher repeat customers” is valid.

Step 1: Segment active customers based on employee size.

Employee size is a good proxy for their yearly turnover (which directly correlates to how much they can pay us). Approximate segmentation:

Based on company size: Solo, 1-10, 11-50, 51- 100, 101-500, 501-1000, 1001+

The country the product champion is based in

Persona of the product champion

Step 2: Reach out to the customers trying to solve revenue generation goals.

Understand what problems they were trying to solve when they started looking for a solution, and why did they choose us?

Do record all interviews, as in live calls, we miss the subtle queues in their facial expression when we ask touching questions.

Also, do interview customers who were qualified to buy, but didn’t choose us. So many good insights often come from this user segment.

Step 3: How many users to interview?

Often 6 users in each segment is good enough. After 6, we often hear the same issues on repeat. Less than 6, we do not have enough confidence in our insights.

The math behind user interviews.

To interview 6 users (1-1), account for a 30% no-show rate. Thus, you need to have 9 users booked on the calendar.

To get 9 users in that user segment on a call, you have to reach out to at least 90 qualified users, assuming the best case 10% conversion rate.

And getting 90 right-fit people to call is a lot of work.

Step 4: Build a Customer Advisory Board.

Find ways to make product champions join the Customer Advisory Board, which meets up every month. This way, they get to see what we are building and give us feedback which we may not have considered without their help. Having regular customer-facing feedback is critical.

Being the middle layer is good, but why not own a KPI?

I have a strong feeling that if you are a middle layer, you end up becoming a commodity unless you have deep integration into the company products (like Twilio).

Drift, by moving away from a chatbot to owning a KPI was able to charge 28 times more, when their service cost per client might have been less than $ 5k per year. That’s a $19k per year gross profit, from a chatbot which costs $840 for an entire year.

By validating the hypothesis listed here, “Customers are willing to pay 10x more if we prove we can deliver higher repeat customers”, and if valid, by implementing it we

Have a clear differentiation from all other Whatsapp CRMs out there

We become more valuable to the end user, as we are more than just a tool. We partner with them to own an acquisition pipeline.

Our LTV per user will grow by an order of magnitude.

I wrote this article as I loved Wati as a product, and wanted to demonstrate my competence. If you find this intriguing and want to have a conversation, please reach me at authenticryanis@gmail.com.

Talk soon!

-Ryan Dsouza